The Business Battery Advantage for Your Office

At its core, a commercial business battery is a strategic asset. It stores energy, giving your company a powerful tool to control power costs, guarantee you can keep the lights on during an outage, and shrink your carbon footprint.

Think of it like a savings account for electricity. You fill it up when power is cheap—either from your own solar panels or the grid during off-peak hours—and then ‘withdraw’ that energy when prices spike or the grid goes down. It's a surprisingly simple concept that builds serious financial stability and operational resilience.

Why a Business Battery Is Your Strategic Advantage

Imagine your operations running without a hitch, backed by an uninterruptible power supply. Your energy bills become predictable, and your green credentials get a genuine boost. A business battery system is so much more than just a piece of hardware; it becomes a central part of your entire energy strategy. It takes what is often a volatile, unpredictable cost and turns it into a manageable—and sometimes even profitable—asset.

In Australia’s notoriously dynamic energy market, this level of control is a massive competitive advantage. It's why more and more businesses are turning to on-site energy storage to insulate themselves from grid instability and ever-changing electricity prices.

The Growing Momentum for Commercial Energy Storage

This shift is part of a much bigger national trend. Australia's battery industry is growing at a breakneck pace, fuelled by ambitious renewable energy policies and a clear public desire for cleaner solutions.

The Australian battery market is on track to hit around AUD 1.29 billion by 2025, which really shows its expanding role in both supporting solar adoption and shoring up the stability of the grid. This momentum alone underscores just how valuable this technology is for any business looking to future-proof its operations.

A business battery isn't just about backup power anymore. It’s an active financial tool that can shave peak demand charges, maximise solar investments, and even generate revenue by supporting the grid.

By installing a business battery, you're not just buying a box. You're gaining the ability to:

- Reduce Grid Dependence by storing and using the clean energy you generate yourself.

- Lower Electricity Bills by smartly avoiding the most expensive peak electricity tariffs.

- Improve Operational Resilience with reliable backup power that kicks in the moment a blackout hits.

- Enhance Sustainability by making sure every last drop of your clean, renewable energy gets used.

This whole approach fits perfectly with modern energy management, like the models you find in comprehensive Energy as a Service (EaaS) offerings. Ultimately, bringing a battery system into your business isn't just a smart move for today—it's preparing you for a smarter, more resilient energy future.

How a Business Battery Actually Makes You Money

A business battery is more than just a backup plan for blackouts. When you start managing how and when you use electricity, it transforms from a simple insurance policy into a powerful tool for chipping away at your operational costs. The real value isn't in waiting for the power to go out; it's in actively taking control of your energy expenses, every single day.

It all comes down to using that stored energy intelligently, playing the game between your own solar generation and the wider grid. For Australian businesses, this isn't just a green initiative—it’s a genuine competitive edge, turning a static overhead into a dynamic asset. Let's break down the three main ways this works in practice.

Maximise Your Solar Self-Consumption

If you've got solar panels on your roof, you know the frustration. You generate heaps of valuable, clean energy during the day and sell it back to the grid for a pittance. Come evening, you’re buying that power back at a much higher price. A business battery flips this script.

Think of it as your own private energy reservoir. Instead of spilling your excess solar power onto the grid for pennies, you capture and store it right there on-site. When the sun goes down but your business keeps running, the battery kicks in, powering your lights, equipment, and servers with free, clean energy you generated hours earlier. This slashes your reliance on the grid and takes a huge bite out of your evening power bills.

Storing your own solar is the simplest and most direct way a battery pays for itself. You’re essentially time-shifting free energy from midday to power your operations after sunset.

Conquer Peak Demand Charges

Many commercial electricity bills contain a nasty surprise: demand charges. These fees aren't based on your total energy use, but on the single highest spike of electricity you draw from the grid, often measured in just a 15- or 30-minute window. Firing up a piece of heavy machinery at the wrong time can inflate your entire monthly bill, even if your average usage is quite low.

A smart business battery acts as your defence against these costly spikes. It's a simple, automated process:

- The system constantly watches your building’s real-time energy consumption.

- When it sees your power draw creeping towards a high-demand threshold, it gets ready to act.

- Instantly, the battery discharges stored energy to handle the extra load, "shaving" that peak off what you pull from the grid.

This proactive peak shaving keeps your demand well below the expensive tariff thresholds, delivering very real savings month after month. For a manufacturing plant, a cold storage facility, or a large retail store, avoiding these charges alone can make the entire business case for a battery.

Master Energy Arbitrage

Arbitrage is a classic financial strategy: buy low, sell high. Your battery can do the exact same thing with electricity. The system can be programmed to automatically charge from the grid during the dead of night, when power is at its cheapest.

Then, during the afternoon peak when grid prices soar, that cheap, stored energy can be used to run your operations. In some cases, you can even export it back to the grid for a profit. This simple timing trick turns the volatile energy market into a predictable financial advantage, making sure you’re always using the most affordable power available.

Choosing the Right Battery Technology and Size

Picking the right business battery is a huge decision. Get it right, and your investment pays off beautifully. Get it wrong, and you've got an expensive box that doesn't do what you need. This isn't just about picking a brand; it’s about matching the battery's chemistry and capacity to your business's unique energy rhythm.

First things first, let's talk chemistry. While there are a few technologies out there, the commercial scene is really dominated by lithium-ion. But even within that family, there are important differences that have a big impact on performance, safety, and your bottom line.

Comparing Common Battery Chemistries

For most business applications, the choice boils down to two main contenders: Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC). Think of them as two different engines. Both will power your vehicle, but they have distinct strengths.

To make this clearer, here’s a quick rundown of the most common battery technologies you'll encounter.

Commercial Battery Chemistry Comparison

| Technology | Key Advantage | Best Suited For | Typical Lifespan (Cycles) |

|---|---|---|---|

| Lithium Iron Phosphate (LFP) | Exceptional safety and long cycle life | Commercial & industrial sites where safety and durability are paramount | 6,000 – 10,000+ |

| Nickel Manganese Cobalt (NMC) | High energy density (more power in less space) | Electric vehicles and applications where space is a premium | 2,000 – 4,000 |

For most Australian businesses, safety and longevity are non-negotiable. That's why LFP technology is almost always the preferred choice. Its robust nature is simply a better fit for the demands of a commercial setting, giving you excellent long-term value and peace of mind.

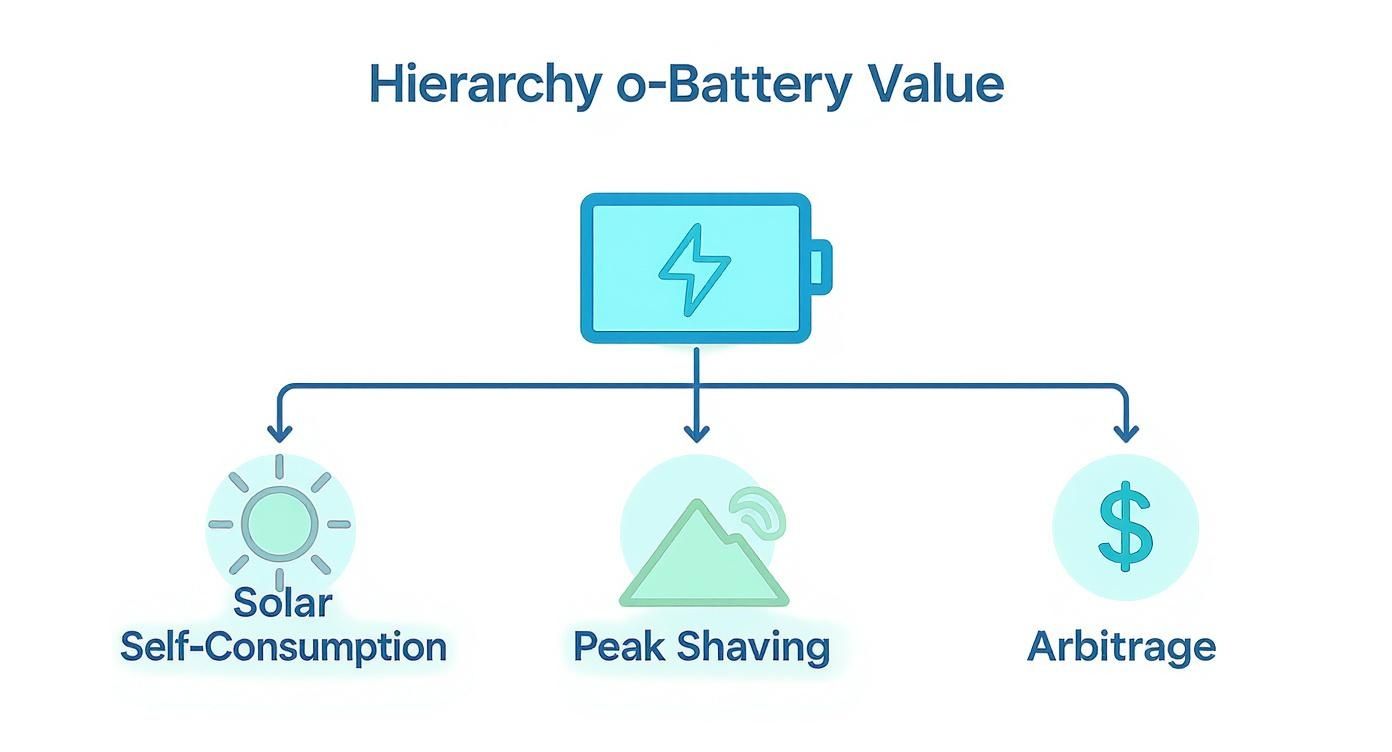

The diagram below shows how a battery's value isn't just one-dimensional. It stacks up through different jobs it can do for your business.

As you can see, a single battery asset can deliver multiple financial benefits at once, from soaking up your excess solar to slashing your grid costs. If you want to get into the weeds on specific models, our detailed solar battery comparison for Australia is a great resource.

Correctly Sizing Your Business Battery

Once you’ve settled on the chemistry, the next critical step is sizing. This isn’t a one-size-fits-all game. It’s a careful balancing act between two key metrics, and getting them right is crucial to avoid over- or under-investing.

1. Capacity (kWh): Think of this as the size of your fuel tank. It’s the total amount of energy your battery can hold, measured in kilowatt-hours (kWh). Capacity determines how long your battery can power your operations after the sun goes down or during a blackout.

2. Power Output (kW): This is your engine’s horsepower. It’s the maximum rate your battery can pump out energy at any given moment, measured in kilowatts (kW). Power dictates how many machines and appliances you can fire up all at once.

So, which do you need more of? A cold storage facility might need high capacity to run coolers all through the night. A workshop with heavy machinery, on the other hand, might need high power to handle the massive surge when those machines kick into gear.

The only way to know for sure is to look at the data. A proper analysis of your energy bills and interval data will reveal the perfect balance for your needs, ensuring your battery is perfectly tuned to do its job.

Calculating Your Return on Investment

A business battery is a serious capital investment. And like any smart purchase, the financial return needs to be crystal clear. Moving beyond the operational perks, building a solid business case means crunching the numbers to understand exactly when and how this asset will pay for itself.

The calculation starts with the total upfront cost. This isn't just the price tag on the battery unit; it includes essential gear like the inverter, the Battery Management System (BMS), and all the labour to get it installed and commissioned. While that initial figure can feel substantial, it’s only one side of the equation.

The other side is where the real value emerges: the savings and revenue your battery will generate day in, day out. Getting a grip on these financial gains is crucial. For a deeper dive into the formulas and methods, there’s an excellent resource on calculating your return on investment.

Quantifying Your Savings and Payback Period

The payback period for a business battery is all about how effectively it slashes your operational costs. This happens through a few key mechanisms that, when combined, create a powerful financial argument for the investment.

You can start tallying up your potential savings by looking at:

- Reduced Energy Bills: By storing up excess solar or cheap off-peak grid energy, you drastically cut down on how much expensive peak-rate electricity you need to buy.

- Demand Charge Mitigation: For many businesses, this is the big one. Using stored battery power to avoid costly demand charges during peak usage times can save hundreds, sometimes thousands, of dollars each month.

- Grid Services Revenue: When connected to a Virtual Power Plant (VPP), your battery can earn direct revenue simply by helping to stabilise the grid.

These combined savings create a predictable stream of financial returns that directly chips away at your initial outlay, shortening the time it takes to get back in the black.

Australian Government Incentives

Australia's push towards renewables means there are significant government incentives on the table that can make a business battery even more financially attractive. These programs are designed to lower the upfront cost barrier and get more storage into the grid.

Tapping into available rebates and certificates is one of the fastest ways to shorten your payback period. These incentives can slice a significant chunk off the net cost of a commercial battery system.

Key incentives for businesses include:

- Small-scale Technology Certificates (STCs): Similar to the well-known solar rebate, STCs provide an upfront discount on the cost of eligible battery systems, especially when paired with solar PV.

- State-Based Rebates: Various states and territories offer their own specific grants or interest-free loans for businesses investing in energy storage. Keep an eye on your local programs.

This trend is also mirrored in the residential sector, which is seeing a similar boom. In 2024, Australia saw a huge 72,500 residential battery installations, a 27% jump from the previous year, showing widespread confidence in the technology.

By combining direct operational savings with these powerful incentives, the financial case for a business battery quickly becomes very compelling.

Earning Money With a Virtual Power Plant

Your business battery can do more than just slash power bills—it can actively earn you money. By joining a Virtual Power Plant (VPP), your battery stops being a passive cost-saver and starts acting like a paid-up member of the energy market.

Think of a VPP as a network of smart batteries, all working together as a team. On its own, one business battery is useful. But when hundreds or thousands are coordinated, they become incredibly powerful. A VPP operator like HighFlow Connect orchestrates all these individual batteries to act like a single, large-scale power source for the grid.

This pooled power is then used to provide essential stability to the national grid, especially when it's under stress.

How Your Business Earns from a VPP

When you join a VPP, you’re simply giving the operator permission to use a small slice of your battery’s stored energy when the grid desperately needs it. This could be to help keep grid frequency stable or to inject a rapid burst of power to prevent a blackout.

For contributing this power, you get paid. It's that straightforward. This arrangement turns your energy storage from a sunk cost into a working asset that pulls its own weight. The main benefits are clear:

- Direct Payments: Earn a consistent revenue stream for letting your battery support the grid.

- A Stronger Grid: Your business plays a real part in building a more resilient national energy network.

- Backing Renewables: By helping to balance the grid, your battery makes it easier to bring more solar and wind power online.

A Virtual Power Plant turns hundreds of separate business batteries into a powerful, coordinated team. This collective strength lets your business participate in energy markets that were once the exclusive domain of giant power stations.

This isn’t a niche idea; it’s becoming central to Australia's entire energy strategy. In 2025, Australia became the world's third-largest market for utility-scale battery storage, with a massive 14 GW/37 GWh of projects in the pipeline. With over AUD 21 billion in investment expected by 2030, the business battery sector is booming, creating huge opportunities for businesses to get involved and profit. If you want to dig deeper, you can discover more insights about Australia's leading role in the battery market on ess-news.com.

Exactly how much you can earn will depend on your system size and where you're located, but joining a VPP is one of the smartest moves you can make to get the best possible return on your investment. We’ve put together a full breakdown in our guide to realistic VPP earnings scenarios in Australia.

Navigating Installation Safety and Compliance

A successful commercial battery project is about more than just the tech. It’s built on a foundation of meticulous, safe, and fully compliant installation. Getting this right from day one is the only way to protect your people, your property, and your investment for the long haul.

The real work starts long before a single tool is picked up. It begins with a thorough site assessment and detailed engineering design to pinpoint the best location—one that considers structural loads, accessibility, and how it will tie into your existing electrical systems. Only then can the physical setup and final commissioning get underway.

Your most critical decision in this entire process is choosing who does the work. It’s non-negotiable: your project must be handled by Clean Energy Council (CEC) accredited installers.

This accreditation is your guarantee. It means the team has been trained to the highest national standards, ensuring your system not only performs as it should but is also fundamentally safe.

Key Safety and Regulatory Milestones

A professional installation team doesn't just bolt hardware to a wall; they manage a series of critical safety and compliance checkpoints. Before you even begin, it's vital to get your head around the essentials of mastering risk and compliance on your worksite.

Your installers will focus on several core areas to deliver a safe and durable system:

- Adherence to Australian Standards: Your system must meet all relevant codes, especially AS/NZS 5139, which specifically governs the safety of battery energy storage systems.

- Proper Ventilation and Thermal Management: Batteries have a sweet spot for temperature. Proper ventilation and cooling are essential to stop them from overheating, which is key to maximising their operational lifespan.

- Fire Safety Protocols: Installers will implement crucial fire safety measures, like ensuring correct clearances and clear access for emergency services, all in line with local building codes.

Finally, a compliant installation means navigating the paperwork. This isn't just a box-ticking exercise; it involves securing a formal grid connection agreement with your local distribution network service provider (DNSP) and getting any other council or building permits sorted. A skilled installer handles this for you, clearing the path from a plan on paper to a fully operational, revenue-generating asset.

Your Business Battery Questions, Answered

Diving into commercial energy storage naturally brings up a few questions. It’s a significant investment, after all, and you want straight answers before you commit. We get it.

Here are some of the most common queries we hear from Australian businesses sizing up their options. Getting these fundamentals right is the first step to making a smart decision that aligns with how you operate and what you want to achieve.

How Long Does a Commercial Battery Last?

There are two ways to look at a battery's lifespan: its calendar life (years) and its cycle life (how many times it can be charged and discharged). Most of today’s lithium-ion batteries, especially the robust LFP models, come with a warranty for around 10 years or between 6,000 to 10,000 cycles—whichever comes first.

But the real-world lifespan hinges on how you use it. Things like operating temperature, how deeply you drain the battery on a regular basis, and your daily usage patterns all play a part. This is why a quality Battery Management System (BMS) is non-negotiable; it’s the brains of the operation, actively protecting the cells to get the most out of them for as long as possible.

Can It Power My Entire Operation During a Blackout?

This really depends on the size of your battery and what you consider "essential." A well-sized system can absolutely keep your critical equipment humming along—think servers, point-of-sale systems, key lighting, and security—to ensure a blackout is a minor hiccup, not a full-blown crisis.

The trick is to first identify your most critical operational loads. From there, you can size the battery’s capacity (kWh) and power output (kW) to support those specific needs for as long as you need, whether it's one hour or eight.

Trying to power an entire factory floor or a large cold storage facility through a blackout would require an enormous and very expensive system. The smarter play is to focus on keeping the core of your business running smoothly until the grid comes back online.

Do I Need Solar Panels to Install a Business Battery?

Strictly speaking, no. A business battery can be a powerful standalone asset. You can set it up to charge from the grid when electricity is cheap (like overnight) and then use that stored energy when prices spike in the afternoon. This strategy, known as energy arbitrage, can deliver real savings and provides reliable backup power, with or without solar.

That said, the numbers almost always look best when you pair a battery with a commercial solar PV system. It allows you to store the 'free' energy you generate on your own rooftop, giving you maximum control over your power bills and fast-tracking your return on investment.

Ready to take control of your energy costs and secure your operations? The expert team at HighFlow Connect can help you design a business battery solution that delivers real value from day one. Learn more and get started today.